Mortgage Broker Assistant Job Description - Truths

Wiki Article

Some Known Questions About Mortgage Broker Salary.

Table of ContentsBroker Mortgage Near Me - The FactsIndicators on Mortgage Broker Average Salary You Need To KnowThe Definitive Guide to Broker Mortgage Near Me4 Simple Techniques For Broker Mortgage CalculatorThe Greatest Guide To Broker Mortgage Near MeOur Broker Mortgage Near Me PDFs

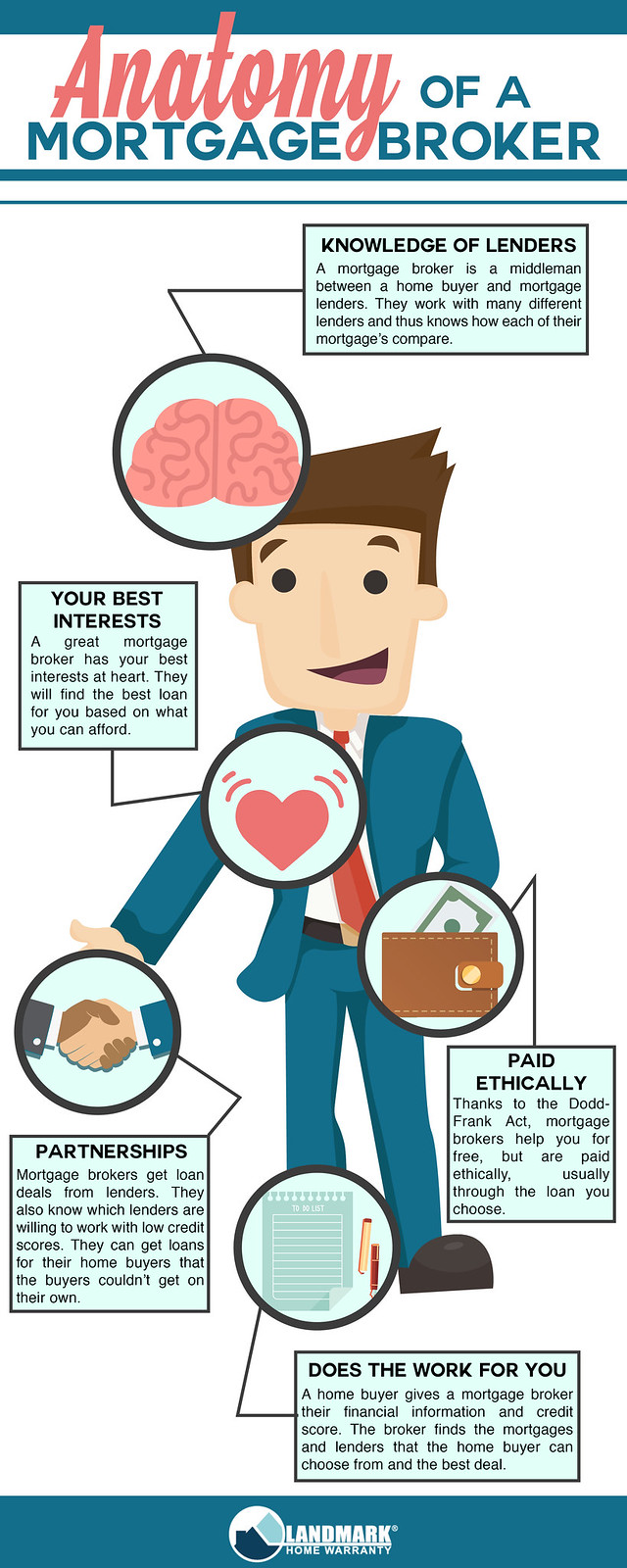

The home mortgage broker's task is to comprehend what you're trying to achieve, work out whether you are ready to leap in currently and also after that match a lending institution to that. Prior to speaking about loan providers, they need to gather all the information from you that a bank will certainly require.

A major change to the sector happening this year is that Mortgage Brokers will certainly have to comply with "Finest Rate of interests Task" which implies that lawfully they need to place the client initially. Interestingly, the banks do not have to comply with this brand-new rule which will certainly benefit those clients using a Home loan Broker a lot more.

Not known Factual Statements About Mortgage Broker Average Salary

It's a home loan broker's job to aid get you ready. It could be that your savings aren't fairly yet where they ought to be, or it might be that your earnings is a little bit doubtful or you have actually been self-employed and also the financial institutions require more time to evaluate your circumstance. If you're not yet all set, a mortgage broker exists to outfit you with the knowledge and also suggestions on exactly how to enhance your placement for a loan.

Your home is your own. Written in cooperation with Madeleine Mc, Donald - mortgage broker vs loan officer.

An Unbiased View of Mortgage Broker Vs Loan Officer

They do this by contrasting home mortgage items used by a range of lenders. A home loan broker serves as the quarterback for your funding, passing the ball between you, the borrower, as well as the lending institution. To be clear, home mortgage brokers do a lot more than assist you get a simple home mortgage on your house.When you go to the bank, the financial institution can only offer you the services and products it has available. A financial institution isn't likely to tell you to go down the road to its competitor that uses a home loan item much better suited to your requirements. Unlike a financial institution, a home mortgage broker usually has connections with (often some lenders that do not straight handle the public), making his opportunities that much far better of discovering a loan provider with the ideal home loan for you.

If you're wanting to refinance, accessibility equity, or get a bank loan, they will need info regarding your existing you could try these out loans already in area. When your home mortgage broker has a good idea regarding what you're trying to find, he can develop in on the. In a lot of cases, your home loan broker may have virtually everything he needs to proceed with a home loan application now.

Mortgage Broker Salary Things To Know Before You Buy

If you have actually already made a deal on a property and also it's been approved, your broker will send your application as a live offer. As soon as the broker has a home loan dedication back from the loan provider, he'll go over any problems that need to be satisfied (an appraisal, evidence of income, evidence of down payment, and so on).This, in a nutshell, is exactly how a home mortgage application works. Why make use of a home loan broker You may be asking yourself why you should use a home mortgage broker.

Your broker ought to be skilled in the home mortgage items of all these lending institutions. This implies you're extra likely to find the finest mortgage item that matches your demands. If you're an individual with broken credit history or you're buying a residential or commercial property that's in less than outstanding condition, this is where a broker can be worth their weight in gold.

Excitement About Mortgage Broker Assistant

When you shop on your very own for a mortgage, you'll require to request a home loan at each lender. A broker, on the various other hand, need to know the lending institutions like the back of their hand and need to be able to focus in on the lender that's best for you, conserving you time as well as securing your credit history from being lowered by applying at a lot of loan providers.Make certain to ask your broker the number of lending institutions he deals with, as some brokers have accessibility to even more loan providers than others and might do a greater quantity of service than have a peek at this website others, which implies you'll likely obtain a much better price. This was a review of functioning with a home mortgage broker.

85%Marketed Price (p. a.)2. 21%Comparison Rate (p. a.) Base requirements of: a $400,000 car loan amount, variable, fixed, principal as well as passion (P&I) mortgage with an LVR (loan-to-value) proportion their website of at least 80%. The 'Compare House Loans' table enables for estimations to made on variables as picked as well as input by the user.

Mortgage Broker Can Be Fun For Anyone

The alternative to utilizing a mortgage broker is for people to do it themselves, which is in some cases described as going 'direct'. A 2018 ASIC study of consumers that had actually secured a financing in the previous year reported that 56% went straight with a lender while 44% went via a mortgage broker.Report this wiki page